Introduction

Every country’s taxation authority frame several rules and policies so as to collect tax revenues for the growth and success of the economy. In Singapore, every citizen is liable to follow SITA (Singapore Income Tax Act) taxation rules and regulations and pay their tax obligation timely to IRAS (Inland Revenue Authority of Singapore) (Alm and et.al., 2010). Section 45 of SITA deals with the withholding tax provisions that is a mechanism developed to generate tax revenues from non-residents (Phang, 2015). According to the section, certain group of non-resident are accountable to pay taxes at a prescribed rate on gross payment as their withheld tax obligations (Chang, Chen, and Chen, 2016). Withholding tax is a mechanism framed by Singapore government to collect taxes for those payments that have been made to non-residents. This report aims at examining the provisions and policies of section 45 of the act and its applicable tax rates for non-residents regarding several specific transactions that are interest, royalties and technical assistance fees. Moreover, the report will also lay emphasizes towards the compliance obligations for the tax contributors. Along with this, it will also identify the situations where withholding taxation requirement can be exempted for the non-Singapore residents as per the legislations and administrative policies.

Operations of S45 of SITA, the rationale for implementation and other relevant sections

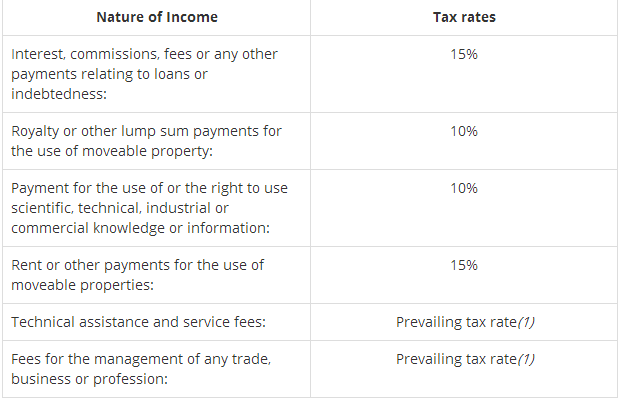

The main reason behind introducing S45 is to arises liability to the non-resident companies or individual who derived any income or receipts that is sourced in Singapore. According to S45 of SITA, when a person makes following payments to non-residents, then he or she will be liable to withheld a certain tax percentage or give to IRAS, called withholding taxes, mentioned below:

- Section 12(6) of the act presented that when an individual makes payments such as interest, management fees, commission or any other for his or her loan, indebtedness, guarantee or agreement sourced in Singapore, then the person will be accountable to pay withholding tax to the ISAR (Fiechter 2010).

- As per section 12(7), when a person gets rights to utilize a movable property and in return make royalty or other kind of payment (lump-sum or instalments) to the property owner, then such person will be accountable to follow the provisions of withholding taxation requirement (Diamond and Diamond, 2013).

- S12(7)(b) – Payment by an individual in connection with receiving utilization rights for scientific, industrial, commercial and technical know-how (Cheng and et.al., 2012).

- S12(7)(c) –If a person pay management fees for getting managers assistance for his or her trading activities, business and profession, then it will come under the requirement of withholding tax (Singapore withholding tax summary, 2015).

- S12(7)(d) – Payment of rent as a financial return to the assets owner who provided rights to use his or her property

- S45F - Payment of remuneration and service fees to directors, consultants, coaches and trainers who are permanent Singapore residents (Abbas and Klemm, 2013).

- Payment made to buy a property from non-resident

- S45G - Distribution of REIT (Real Estate Investment Trust) (Koh and et.al., 2014) and S45E - withdrawing SRS (Supplementary Retirement Scheme)

Tax treatment of 3 payments, interest, royalties and technical assistance

Section 45 with subject to interest payment

SITA’s section 45(1) to (7) is applicable for withholding tax requirement in connection with interest payment to a non-resident. If a person pays interest to an unknown person as he or she is not a regular or permanent citizen of the nation, then the person will be accountable to pay withholding tax at an application taxation rates (Pfister, 2016). For instance, interest due on account for trade and credit terms that have been paid to a non-resident. Moreover, it also consists of interest liabilities on delayed payment under sales of goods act. As per SITA act’s section 45, interest payment made in relation with any indebtedness and loans will be taxed at the specified rate of 15% (Shurtz, 2010). Apart from this, as per subsection (1), on every payment (except 43(3)) that has been made after 1st Jan, 2004, 22% tax will be deducted (Alm and Torgler, 2011). While making such payment, it is the duty of taxpayer to deliver a notice immediately to the comptroller. After this, comptroller may decides that whether a person will be taxed at higher or lower tax rates @ 20% or mentioned rates in section 43(3) (Djankov and et.al., 2010).

Section 45 with subject to royalties

In connection with section 45A, when a person obtain rights from the real property owner (non-resident) to use the assets without getting ownership, then, as a monetary return, person will have to pay royalty or other lump-sum payment to the real assets owner. On the amount of royalties and lump-sum payment made, person will be obliged to pay a withholding tax at the rate of 10% (Understanding Withholding Taxes, 2011). Owing to this, it is an essential requirement to differentiate the outright sale of property like intellectual property and software) and payment made as a royalty in connection with obtaining the rights to use the movable properties without acquiring legal rights (Sharkey, 2015). Alternatively, it can be said that it will only transfer the possession of the property not the legal ownership. The tax burden can be either bear directly or indirectly by the person, or it will be considered as deductible or allowable expenditures for the payer (Markle and Shackelford, 2011).

Section 45 with subject to technical assistance fees

According to the withholding taxation provisions and policies, IRAS mentioned that there is no taxation liabilities for the payment made in relation with transportation expenditures, reimbursement of hotel accommodation as well as meals. As per the provisions, when a person pay fees so as to get any kind of technical assistance from a non-resident, then on such kind of payment, prevailing rate of taxes will be considered as a chargeable tax rate (Withholding tax and technical assistance fees, 2015). Currently, in Singapore, corportations are liable to pay taxation rates @ 17% on their net earnings; however, the individuals are accountable to pay tax @ 20% that has been increased to 22% per annum in the year 2017 (Han, 2010).

Taxation rates can be modified and altered by the government through signing the Double Tax Agreement (DTA) by both the recipient’s nation’s residence and domestic nation, Singapore (Teng, 2013).

Consequences of defaulting withholding tax payments

If an individual did not meet out his or her withholding taxation liabilities on right time, then such taxpayer will be penalised under the act’s provisions, mentioned hereunder:

Penalties for non-compliance with the taxation liabilities

S45(1) clarified that deducted amount of taxation will be considered as a debt due to the IRAS. Thus, if person fails to comply with such provisional requirement and did not pay taxes timely, then, as per section 89, such amount can be recovered by the authority (Understanding Withholding Taxes, 2011).

Penalties regarding failure to notify statutory authority, IRAS

In addition to the above, if person fails to give notice or relevant form IR37 to the comptroller on right time, then the for such conviction, 3 times of the tax liabilities will be charged as penalty and taxpayer also will be accountable to pay a fine of maximum $10,000. Moreover, person can also sent to jail for a period not exceeding to 3 years (Atkinson and Piketty, 2010).

Penalties in connection with delayed payments

If a person paid delayed taxes to the authority, then, on 15th day of next month, 5% tax will be payable by the person (Teng, 2013). If tax duties still did not meet out, then, such taxpayer will be penalised @ 1% of additional penalty. In such circumstances, total penalised amount cannot exceed maximum of 20% on outstanding taxation liabilities on interest payment.

Tax exemptions

There are several situations where act provide exemption to the payers from the withholding taxes that are presented below:

- Shrink-wrap software

- Software that are available for download by end-users

- License for site (Diamond and Diamond, 2013)

- Software bundled with hardware of computer

- Scientific, industrial, technical and commercial knowledge rights obtained from 28th Feb 2008 to 27th Feb, 2013 (Understanding Withholding Taxes, 2011).

- Payment made with subject to lease for satellite capacity from 11th July 1997 to 10th July, 2012.

- Payment in connection with use of an international submarine cable capacity, also includes IRU (Indefeasible Rights of Use)

Press release of real cases of withholding tax in Singapore

A recent press release has been published in 2017 by Terry Horstman explaining employer withholding taxation amendment increase accuracy and maximization of fraud prevention efforts. Published press release has considered withholding taxes as trustworthy taxes (Terry Horstman, 2017). The report also founded that majority of the income tax revenues came in the form of withhold taxes from the employees as in 2016, total receipts from withholding taxes has been generated around $12 billion that is equal to 80% and 60% of the individual and total income taxes.

Conclusion

The above project report concluded that Singapore’s taxation authorities had designed an excellent tax mechanism for withholding taxes. The report identified that on interest, royalties and technical fees, taxation liabilities are charged at 15%, 10% and 17% (on companies) and 22% (on individual) respectively. At the end, report also founded that SITA also provided several tax exemptions to the taxpayers such as shrink-based software, license, IRU and others, for which, taxpayers are not liable to pay withheld tax.

References

- Abbas, S. A. and Klemm, A., 2013. A partial race to the bottom: corporate tax developments in emerging and developing economies. International Tax and Public Finance.

- Alm, J. and et.al., 2010. Taxpayer information assistance services and tax compliance behavior. Journal of Economic Psychology.

- Alm, J. and Torgler, B., 2011. Do ethics matter? Tax compliance and morality. Journal of Business Ethics.

- Atkinson, A. B. and Piketty, T., 2010. Top incomes: A global perspective. Oxford University Press.

- Chang, C. W., Chen, M. C. and Chen, V. Y., 2016. Are Corporate Tax Reductions Real Benefits under Imputation Systems?. European Accounting Review.

- Cheng, C. A. and et.al., 2012. The effect of hedge fund activism on corporate tax avoidance. The Accounting Review.

- Diamond, W. H. and Diamond, D., 2013. Foreign Tax and Trade Briefs-International Withholding Tax Treaty Guide. LexisNexis.