Introduction

The sufficient amount of money available to an enterprise for spending in the way of liquid security, credit lines and cash are called financial resources. Before going into organization, an entrepreneur requires to secure appropriate financial resources or initiative in order to operate sufficiently and efficiently well to encourage success(Allen, 2012). Managing financial resources purpose to inform the principles which are involve in the financial management resources. It motives to render practising non-financial administrator with a knowing of the techniques and terms of accountancy so they may transmit properly with the realise of financial report. This project is mainly based on a proper contract or agreement for FCO (Foreign and Commonwealth office), it is a government department in United Kingdom. The main aim of this business is to innovate their project appropriately which is testing and monitoring of water quality. The present assignment is based on Managing Financial Resources which covered different tasks. Understand and implications of financial resources are determined in this project. Financial decision about different kind of data and information regarding financial statement also analysed in this study. Analysis of financial performance of an enterprise which is also determined in this assignment.

Assignment Prime is an online assignment writing service provider which caters the academic need of students.

Task 1

LO1

1.1 Identifying the finance source

Finance is a term that introduced as the provision of fund or money at the time period when it is highly required. Each and every organisation, whether small, medium or big, needs finance in order to carry on its business operations and to attain long term targets. There are large number of options are present to the FCO to complete their monetary requirement and achieve maximum profit. Some resources are determined as below:

Debt Factoring: It is one of the best and essential resources because it saves the customers pursing time. It is a powerful techniques that companies can apply to enhance their cash flow (Aizenman and Pinto, 2013).

Long-term Bank loan: It is another important and useful tool which is used by each and every organisation in order to arrange sufficient amount of money. Main advantage of this resource is provide power to the company to buy machinery and apply it in the organisation with purpose to maximise their sales.

Short term bank loan: It is another tool which is give by bank to the enterprise for a fixed amount of money. It is used by all organisation to collect sufficient fund in order to run their business operations smoothly (Cases and et. al., 2011).

Financial assistance: With the help of this tool business organisation can meet their fund necessity by taking fiscal support from their family, neighbours, relatives, friends and so on.

Lease Financing: It is introduced as agreement in which the lessor purchased assets in initially. Thereafter, users who pays a particularized rent at journal intervals.

1.2 Assess the implications of the above identified sources

Finance is one of the necessary and essential requirement of each and every organisation in order to do their activities and functions in an appropriate manner. Above discussed all resources such as debt Factoring, long-term bank loan, short term bank loan, financial assistance and lease Financing (Working out what your business should spend money on, 2018). All these are highly essential and important for the FCO to organise different policies and strategies appropriately. Debt factoring is beneficial for the organisation because it saves time and give proper fund. On the other hand, bank loan also important part of collecting accurate amount of fund. In this commercial bank gives capital to the organisation for various motive such as acquisition, expansion and start-up of fixed assets such as land and machinery, plan and many other.

Lease financing it is another important and essential part which is used by all business organisation to arrange proper amount of fund. It is highly required to improve cash flow and achieve long term targets in minimum time period. Financial assistance also beneficial and important for the company to gather money from relatives, neighbours, friends, family members and many other. In order to implement all these resources in the enterprise, management should tries to apply different tools and techniques which help in maximisation of profit (Conway, 2013).

1.3 Appropriate source of finance for a business projects

There are different proper sources of finance which is used by each and every organisation in an accurate manner. All these are identified as below:

Bank loan: It is main and essential tool which is apply by company in order to gather sufficient amount of fund. It acquire agreed over the time period and interest rate of repayment. There are some advantages and disadvantage of this tool are determined as below:

Advantages: Main benefits of this tool is lower interest rate as compare to bank overdraft. It is appropriate approach of funding fixed assets (Coombs, 2014).

Disadvantage: It is more costly because of interest payment. Bank loan required to provide security against the amount of loan.

Retained profit: It is refers as an own funds and capital which is used by enterprise in order to do their entire functions and projects in appropriate manner. There are some pro and cons of this aspects which are shown under this:-

Advantages: Retained earning is cheaper financial sources which is applied by all organisation to gather sufficient amount of capital.

Disadvantage: It is not proper for the company to utilise fund and capital for purpose of doing all projects systematically.

Equity share: It is another tool of finance in order to complete business projects in limited time period. It represent ownership position in an organisation. It is apply by company in order to retain gearing ration of capital. These are some strong and weak point of this resources which are determined as below:-

Advantages: In this business entity not required to repay the capital amount. This source provide strong financial base to the company.

Disadvantage: In this Equity stockholder can put hindrance for administration by organising and manipulation themselves. Another is only issued equity share, the business can not proceed the benefit of commercialism on equity (Cowling and Mailer, 2013).

LO2

2.1 Analyse the cost of above identified finance source

Above discussed all financial resources are important and useful for the organisation to manage their all work and activity in proper manner. With the help of different financial resources company easily to do their all functions and operation in an accurate manner. Some cost of various resources are determined as below:

Opportunity cost: This cost is apply in order to earning retained profit which is essential for the organisation to arranging sufficient fund. It is used by company to maximise their sales and revenues in limited time period. Business analysis the proper utilisation of such tool to make different resources (Elterich, 2011).

Cost of Equity: It is the return a business that needs to determine if an accurate investment meets with capital return. Cost of equity of the company shows the compensation or repayment the demand of market in exchanging asset and supporting ownership risk. There are certain cost which is paid in the way of listing, issuance, administration and many other at the time period of shares insurance.

Bank loan: It is another important sources which is important for the FCO to arrange proper fund at a time period. Monetary value which leads to obtain on such activity i.e. interest. Therefore , management of company have to proceed this tool in such manner then proceed loan from any other bank.

FCO can select the Bank loan as a financial resources which is beneficial for arrange accurate money amount. Main owner of the company is its stakeholders and they can contract from their present investors to help in this relation. Therefore, business entity has fixed dividend from which they never track to pay maximum.

2.2 Importance of financial planning

Planning is an essential term and process for the organisation to accomplish their predetermined goals and objectives in an appropriate manner. Financial planning is introduced is a management process in which they set some targets and goals according to the appropriate budget in order to capitalise appropriately. It is mainly handled finance manager, responsibility and role of this department is to arrange and distribute sufficient amount of capital about project. It is also define as an ongoing activity supported in taking an effective judgement for the long term objectives in link with achievement of targets (Hailey, 2013).

Importance of financial planning: There are some significant of financial planning which are determined as below:

- Financial planning assist in decreasing the risks on the company and render development and strength to enterprise.

- It gives confidence or authority that entire things are automatically completed adequately.

- Financial planning decrease the stress and confidence level of business entity in order to achieve long term goals and objectives.

- It's also helpful and beneficial in recognising the actual financial position and image of a business in marketplace.

- It identified relationship between outflow and cashflow of an organisation in order to create proper decisions (Jackson, Ones and Dilchert, 2012).

- It also help in increasing the profit and sales of company in limited time period.

An organisation have to identify significance of financial planning, it is highly essential for them to maximise their profitability ratio. For implementing the accurate plan, FCO have to create an accurate and effective planning about taking financial decision. All these things are important for the organisation to complete their project in allotted time period.

2.3 Assess the information which needed for decision makers

There are different decision maker that needed some information. Few decision-makers are determined as under:

Employees: They are identify as one of the main part of the company that are more interested in order to provide their services in stable and profitable organisation. So that, employee can secure their employment for long time period and will be tension free regarding their job safety or security (Knippschild, 2011) . Furthermore, high return income Foreign and Commonwealth enterprise will be capable to increase employees rewards, salaries and many other advantages, which is move, satisfy individual to a better extent.

Customers: They are known as external part of the company and environment. Expectation of each and every customer is to receive good quality, need better infrastructure and so on. In this manager take an effective decision to provide quality product and service to the customers at reasonable price. They are main people for the business success and growth because they are associate with quality and profitability data. They also analysis ethical compliance data to deals with effectively.

Lender: They are also refer as an important person in the organisation. Lender play vital role in providing accurate amount of capital to the enterpriser for their business expansion, set-up and many others. Thus, their basis data needs is to assess business capability to return debts time to time. Henceforward, the capability to have cash earning and debt ability that are evaluated by the lender in order to take possible lending decisions.

Supplier: It is an individual that are willing in order to tell the timely payment and raising fund to outside. Henceforward, they require data to make complete confidence regarding the repayment of the money on actual data without any time lag (Lusardi, 2011).

Government: They are also a main part of the external environment that are mainly linked to business profitability and success. They regulate business activities routinely in an effective manner. Furthermore, law suit and penalties are charged by legal authority for any illegal or unethical business practices including tax evasion as well as application of harmful matter in product preparing. They regulate some rules and regulations in order to evaluate the amount regrading payable tax.

2.4 Appearance of finance sources in the financial statement

There are different resources of finance that impact on financial statement are determined as below:

|

Sources of Finance |

Balance sheet |

Profit and loss account |

Cash Flow Statement |

|

Bank Loan |

It maximise the cash balance about business Liability and assets with a bank loan. |

Fixed rate of interest is provide over the amount of loan which is maximise expenditure. It decreased profit and recorded payment. |

It maximise the cash inflow in during financial activities. Interest payment is take down the cash balance. |

|

Retained Earning |

Putting amount of money in reserve funds maximise in the cash balance. It maximise the reserve monetary money under equity share capital. |

In this no cost is related so there is no effect over such statement (Massingham, 2014). |

It maximise the cash balance of operations activities. |

|

Equity share |

Under assets, it maximise cash balance and increase equity capital in term of liability. |

In this dividend is exchanges with the investors and it gathered under expanses. |

It maximise financial activities cash balance with the shares issue. It reduce the cash balance of divident payment. |

LO3

3.1 Budget analysis and make appropriate decision

Budget can be defined as an estimate of cost, resources and revenues over specific period of time. Budget statement is useful for estimating financial position, financial result and cash flows of businesses at particular point of time. Preparation of budget is essential for every organisation (Budget - What is a budget?, 2017). This report compares budgeted revenue and expenses figures with actual performance numbers attained during particular accounting year. It taken into consideration current financial status of the company so that proper budget can be made. Budget is categories into three types:

- Forecast Budget

- Performance Budget

- Cash Budget

On the basis of these budget statements, company can effectively achieve their future goals. Foreign and Commonwealth office have to generate cash budget statements and on the basis of that who expenses of company will proceed further. According to given investment information, the company can not bid more than £300,000. Therefore, they are require to manage their budget accordingly (Mohammad and et. al., 2011).

|

Particulars |

April |

May |

June |

July |

August |

September |

|

Opening balance |

15000 |

6500 |

2300 |

15000 |

5640 |

13980 |

|

Cash Inflow |

||||||

|

Credit sales |

14000 |

25000 |

32050 |

24060 |

33000 |

27000 |

|

Cash sales |

7500 |

10500 |

12000 |

14550 |

31000 |

26000 |

|

Total Inflows |

36500 |

42000 |

46350 |

53610 |

69640 |

66980 |

|

Cash outflow |

||||||

|

Credit purchase |

10000 |

14000 |

11000 |

15000 |

13000 |

21000 |

|

Cash Purchase |

9500 |

11500 |

12000 |

13400 |

20600 |

14900 |

|

Loan repay |

0 |

300 |

340 |

280 |

550 |

450 |

|

Interest |

0 |

200 |

190 |

180 |

100 |

130 |

|

OD Interest |

200 |

600 |

750 |

680 |

500 |

450 |

|

Wages |

3000 |

5000 |

2300 |

10600 |

10000 |

15200 |

|

Capital expenditure |

2300 |

3100 |

4320 |

1540 |

9200 |

8000 |

|

Allowances |

310 |

1500 |

1100 |

2200 |

2400 |

1300 |

|

Total Outflows |

25310 |

36200 |

32000 |

43700 |

56350 |

61430 |

|

Surplus/Deficit |

11190 |

5800 |

14350 |

9910 |

13290 |

5550 |

According to this budget report it can be figured out that there all projects are positive in nature i.e. none of their project is suffering from cash deficit. This interprets that company is maintaining its good financial position in the market and also their debt financing ratio will not hamper because of its strong market position over other rivals. Thus it can be concluded that decision taken by Foreign and Commonwealth office in regard to this context is appropriate and adequate in nature (Pannicke, Berlinger and Dopf, 2013).

3.2 Calculation of unit cost and pricing decision for selected contract

Unit cost can de defined as the total cost of particular project in relation to its selling and manufacturing. In order words, it refers to the cost that incurred while manufacturing the one unit in the form of material cost, labour cost and many more cost specifically related to it. It include fixed, variable and overhead cost. This method is useful for company as it assist them in taking price decision in an effective manner. For calculating this cost it is important to calculate the total cost first and then divide it by number of units manufactured or produced. Unit pricing helps the company in taking appropriate pricing decision regarding particular product.

Methods of unit cost calculation: There are mainly two ways to calculate unit cost pricing which are discussed below:

Marginal costing: Under this method, fixed or indirect cost does not taken into consideration by company's while computing the unit cost (Renz and Herman, 2016).

Absorption costing: This method covers both variable and fixed cost for calculating unit cost of a particular product.

Foreign and Commonwealth office needs to identify their unit first and then accurate decision regarding fixing the price. As per the given contract the company is not allowed to go or bid beyond the limit £300,000.

Profit = £10 * 10% = £1

Selling price = 10 +1

Selling price = £ 11 per unit

The selling price computed for particular product is £11 which is computed by using cost plus method. All essential things are added into the price of product and then its final cost gets identified (Simonovic, 2012). This method also add VAT amount and mark up amount over calculated unit cost. By the help of this method they become enough capable in terms of fixing certain amount of profit for attaining adequate profit margin.

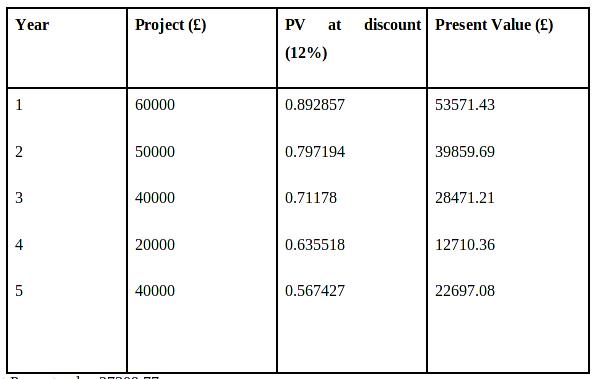

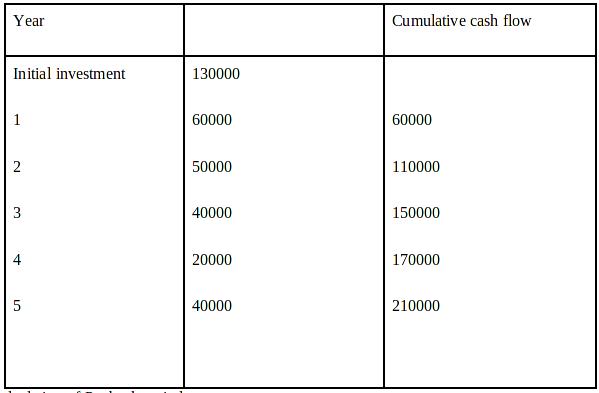

3.3 Variability of project for selecting appropriate investment appraisal technique

It is important for every company to spend or utilize money at right place and on right time. There are various investment appraisal techniques that assist company in finding out where they need to spend their money which gives them higher return (Smith, 2014). Following are some of its methods:

- Payback period

- Internal rate of return

- Accounting rate of return

- Net present value

Foreign and commonwealth office are required to use payback and internal rate of method.

Net Present value 27309.77

Calculation of Payback period:

=2 + 20000/40000

= 2.5 years

Recommendation: It can be figured out that company needs to go out with this particular project as in 2.5 years the loan company have taken will get easily repay.

Task 2

4.1 Discuss the main financial statement

Financial statement is a formal record of all financial activities and position of a company or person. It is mainly prepared by management of business and it interprets its financial performance throughout the year (Snyder and Robert, 2011). It include balance sheet, cash flows, statement of owner's equity and income statement. The main purpose of these statement is to provide information to outside users like investors and creditors regarding company's financial position. Moreover such statements are the main source of financial information for most decision maker.

Income Statement: This statement shows net profit and net loss of the given company. This statement mainly track all the money that is coming in and going out. Money coming in are known as revenues and paid out are called as expenses. Further when revenue exceeds expenses, the income statement shows net profit and when expenses are more than revenues, it shows net loss (Vassolo, De Castro and Gomez-Mejia, 2011). It generally broken down into 3 categories involving:

- Sales

- Operating Expenses

- Non-operating expenses

Sales covers all cost of good sold, non-operating expenses include interest on borrowed money and one-time purchase and operating expenses encompasses things like advertising and office rent.

Balance Sheet: It is a summary of firm's position on one day at certain point of time. It includes assets, owner's equity and liabilities on one particular date. The asset covers cash, stock, bills receivable, property, land, machinery, patents and everything else owned by company. Liabilities include type of payment made on a long term loan and account payable. Owner's equity is calculated when amount of liabilities is subtracted from amount of assets (Wilhite, Sivakumar, and Pulwarty, 2014).

Assets=Liabilities + Shareholder's equity

Cash Flow Statement: This statement interprets inflow and outflow of cash throughout the year. The number of categories in cash flow statements may vary from one another depending upon the size of business. For large entities like Sainsbury, categories include:

- Investing activities

- Operating activities

- Financing activities

- Supplemental information

And for small companies there are only two categories exist one is cash inflow and cash outflow. The main purpose of this statement is to figure out the sources from where cash is coming and going out. Also, it enables the business to determine whether they are spending more they are earning or vice-versa. If amount of cash is continuously higher than net income, than it signifies that firm's net earning are “high quality” (Working out what your business should spend money on, 2017).

Statement of owner's equity: This statement depicts the change observed in owner's equity. It's key components are:

- Begin equity balance

- Addition and subtraction

- Ending balance

4.2 Comparison between different types of financial statement

|

Basis for comparison |

Income Statement |

Cash flow Statement |

Financial Statement |

|

Meaning |

It is a part of financial statement that interprets gains, revenues, expenses and losses for particular accounting period. |

This statement reflects inflow and outflow of cash throughout the year. |

This statements represents financial position of the company in the market for a particular fiscal or accounting year. |

|

Divided into |

Three activities including sales, operating expenses and non-operating expenses. |

Three activities including investing, operating and financial activities. |

Two categories one is Asset and other is Liabilities. |

|

Basis |

It is based on accrual system of accounting wherein expenses an income of particular financial year are considered. |

It is based on cash system of account i.e. considering actual inflow and outflow of cash. |

It is also based on accrual system of accounting. |

|

Objective |

To figure out owner's equity and profitability. |

To determine solvency and liquidity of business. |

This statement provide information regarding company's financial performance and position in market. |

|

Preparation |

It is prepared on the basis of various records and ledge account. |

It is prepared on the basis of income statement and balance sheet |

It is prepared on the basis of all other statement including income and cash flow statement. |

|

Depreciation |

It is included in income statement |

It is not included in cash statement |

It is included in financial statement |

4.3 Interpret financial statements using appropriate ratios

Current Ratio: This ratio determines the level of company's liquidity. It interprets whether company is able to pay their debt within one year of current assets (Wilson, 2015). The idea current ratio for any company is 2:1. If businesses are having high current ratio it indicates that they are not efficiently using their current assets or its short-term financing liabilities.

|

Current ratio |

Current asset/ current liability |

(6312 / 8573) = 0.736 |

This shows that Sainsbury is not effectively utilizing their currents. Though it has increased from last year. In 2016 the current ration was 0.66 and in 2017 it was 0.736.

Liquid Ratio: This ratio determine firm's ability to pay off its short-term debt obligations. This is mainly done by comparing company's liquid assets, those that can easily be converted into cash within an year with its short-term liabilities.

|

Liquid Ratio |

(Cash equivalents + marketable securities + accounts receivables)/ current liabilities. |

(1183 / 8573) = 0.137 |

The ideal liquidity ratio is 1:1 which Sainsbury is not having. In-fact there is decrease in their liquidity ratio as compared to year 2016.

Debt-Equity Ratio: This ratio determines relative proportion of shareholder's debt and equity used to finance firm's assets. High debt ratio indicates that firm is not able to yield enough cash in order to satisfy its debt obligation (Smith, 2014).

|

Debt-Equity Ratio |

Total liabilities/ shareholder's equity |

(625 / 6872) = 0.090 |

Comparing it from last years it can be concluded that there is an increase in Sainsbury debt equity ratio. This indicates that they are effectively meeting financial obligation.

Gross Profit Margin: This ratio is used to assess company's financial health in terms of money left with the company from revenues after accounting for COGS. It represent the percentage of revenue left with the company after deducting cost of goods sold.

|

Gross Profit Margin |

(Revenue-cost of good sold)/total revenue* 100 |

(1634 / 26224)*100 = 6.23% |

This shows that Sainsbury is making good profits but still it is low as compared to retail industries.

Operating Profitability Ratio: This ration indicates how much profit business entity is making after pay all variable cost of production such as raw material, wages etc.

|

Operating Profitability Ratio |

(Operating income/ sales or revenue)*100 |

(642 / 26224)*100 = 2.448% |

Comparing it from last year it can be interpreted that the efficiency of Sainsbury over controlling the expenses and cost has decreased (Renz and Herman, 2016).

Return on Capital Employed: This ratio help in determining company's profitability. It defines the total amount of capital used for profit acquisition.

|

Return on capital employed |

(Earning/capital employed)*100 |

(2280/19737)*100 = 11.551% |

As compared to previous year, there is a rapid increase in Sainsbury's return on capital employed ratio. This indicates that company has achieved good profits in the year 2017.

Conclusion

From the above mentioned report, it can be concluded that finance is necessary and essential for the each and every organisation to do their all activities in proper manner. In order to arrange sufficient amount of fund, company use different resources which help them to maximise their image in marketplace. Financial planning is more essential for the enterprise to accomplish their long term goals and objectives in limited time period. There are mainly three types of decisions which are used by management, customers and government. All these financial resources are effects on financial statement such as balance sheet, profit and loss account and cash flow statement.