INTRODUCTION

Finance is the lifeblood of every business whether it is hospitality or any other industry, without finance it is impossible for the businesses to operate in the market successfully. Procuring finance for the business is one of the most essential and critical task of the managers. Because of the existence of the complexities in the business , financial models are evolved for achieving the common objectives of the organisation. Therefore it is a great opportunity for the managers for introduction of individual jobs and the reasons that has motivated them to select the right path for attainment of objectives in business. This will assists the accounting managers in understanding the techniques of accounting in hospitality sector such that more enhanced results can be generated in given time period( Yuan, Li, and Zeng, 2018).

The motive behind the analysis is to formulate financing decisions in the hospitality industry so as to improve the effectiveness of financial management. This project will perform an evaluation about the various sources that are available for the purpose of funding and the techniques that are available for income generation. Understanding the elements of cost and systems are discussed under the report.

TASK 1

1.1: Reviewing the sources of finance available to business

There are various sources of funding that are available for the “Trident group” from where they can manage the funds for the operations of business. The sources of funds are broadly divided in two categories namely Long term sources and short term sources, these are discussed in brief as under:

Short term Finance:

This is a source of finance which the company undertakes so as to get the additional funds for the regular operation of the business. The short term finance is available for one accounting year and the company has to repay the amount in that particular time. Some of the basic components of short term finance include:

- Bank overdraft: This facility is provided by the banks to the current account holders , under this the bank will allow the business to withdraw the amount up to certain limit. Under the bank overdraft the account holder is allowed to withdraw the extra amount from the bank then the existing balance in his account. Under this method, the bank may also require the business to put some collateral and they charge a certain fixed interest on the extra amount withdrawn for each day until the amount is repaid.

- Accounts receivable financing: Many of the commercial banks and other small financial institution provide the facility of discounting the invoice. Under this method the business , transfers their commercial bills to the banks, against which the bank makes the payment by deducting a small fee. And when the due date occurs the bank collects the payment from the customer. This is considered as one of the most famous short term financing generally among the small traders.

- Customer advances: There are various companies that have a good brand image, which insists the customers to make the advance payments before selling or providing goods and services to them. This technique is applicable on the large orders which require a long time to accomplish. This provides the business the funds for the operations that will be required to execute those orders.

Long term Finance:

- Long term loans from banks: The businesses which have surety regarding their earnings in the future or the companies who are confident about the consistency of the profits in the business, are generally the ones who opt for loans from bank as they are cheaper then equity but the interest payments are required to be consistent whether there is profit or loss( Tsai, Pan, and Lee, 2011).

- Equity Financing: When the companies operate on large scale, they generally require a source of funding which provides them a large amount of money. Under this the companies issue shares to the general public and those who buys the shares become the shareholders and the company is required to pay dividends to them.

- Retained earnings: Retained earnings are those part of the profits which the company retains after distributing the profits of the company to shareholders. Sometimes the company uses these retained profits to fund the activities of the business.

- Venture Funding: This is also a good source of funding which the businesses can opt in the early stages of their operations. The venture funding is provided by financial institutions to the company in the early stage and then they withdraw after the company has developed to a certain position.

1.2: Various forms of income generation methods

The companies have different methods from where they can generate the income for sustaining the operations of the business. At a certain point of time the company can undertake any combination of these techniques and utilise them which is crucial kind of planning related to business. These are discussed as under:

- Fee-for-service: This is a form of charging component for the business where they charge customers for the social services so as to recover the cost of service provisions( Sisson, and Adams, 2012).

- Products and Services: Under this income generation method, the income is earned by manufacturing and sales of product or by re-sailing the products or through mark-up. The income generation through providing services include merchandising the skill set of a person or providing expertise to the market who is willing and able to pay.

- Investment Dividend: The Income that is generated by the business with help of the Investment done by the company are best for the purpose of funding the operations of business. Under this interest or dividend received from the investment done by the company are included.

TASK 2

2.1: Discuss Elements of cost, gross profit percentage and selling price

The Cost is the approximation regarding the amount which the company has to pay for the total capital that is acquired by the business and in the production of the products and services. Some of these elements are quite significant for improving the operations and productivity of the business:

Direct material: These are those costs that are related to the to the manufacturing and production department of the company. The cost related to the production department vary with the output level that the company is producing. Primarily enclosing material and half developed products are the examples related to direct material(Paster, 2013).

Indirect material: These are considered as those material which is used in the production process as the secondary tool for easing the handling of the physical units. The examples of these includes oil and waste and stationary products.

Direct labour: The direct labour constitutes that employees who are involved in the production and manufacturing process relates to goods and services of company. This is called as direct as this impacts the cost of goods and services directly( Lupton, 2013).

Indirect labour: The indirect labour are those employees and workers which do not impact the cost of goods and services directly or that labour which is not engaged in the production process. The indirect labour are that employees which are involved in activities such as selling and administration which impacts the cost indirectly.

Expenses: This refers to the cost which is incurred during the operations and production activities of the business. The expenses of the company are are further classified into two broad categories namely Direct expenses and Indirect expenses.

Overheads: The overheads of the company are also the combination of variable and fixed costs. The overheads of the company are related to factory, office, selling and distributions.

Gross profit percentage: The gross profit percentage of the company is calculated as gross profit that is made by the company divided by the total revenues made by company during a year. The basis for calculating the gross profit is the net revenue of the company it is done as under:

GPP(Gross profit percentage) : Gross profit / Total sales* 100

Selling price + COGS+ Gross profit= This has been observed that net profits of the company are calculated by deducting the other overheads from gross profit margin. Firstly , the company prepares the trading account for the determination of gross profit and then calculates the net profit by preparing income statement.

2.2: Evaluate methods cash and stock control system

This is significant for the companies in hospitality sector such as Oberoi group to determine the operation of the company in much efficient manner. According to which it is necessary to maintain the cash and stock as these are major elements of workigncapital of the company( Liu, 2012).

Cash Control methods:

- Set cash flow limits: The companies should set a standard limit on spending of cash and managers should regularly forecast the cash balances.

- Making payment getaway more simplified: the managers recommend and focuses on removing the payment options through cheque as it requires time to encash.

- Provide healthy package to guest: By using a fixed package rates the companies in hospitality sectors would assists in controlling cash transactions from extra flows.

Stock control techniques:

- Identification of annual policies related to inventories: This will assist the company for the analysis of maximum and minimum levels of inventory which has to be kept in storehouses. There are different techniques such as LIFO, FIFO which assists the managers in the examination of inventory level of the company.

- Inventory turnover ratio: this refers to the sum total of time which the company requires to sell the goods in the inventory. It is calculated as cost of goods sold divided by the Average inventory of the company.

- ABC costing: This technique of inventory management assists the managers in dividing the total stock of the company according to the durability of the goods.

TASK 3

3.1: Assess the source and structure of trial balance

Trial balance of the company is prepared using the journal book and ledger of the company. The preparation of trial balance is the first step in the preparation of financial accounts of the business. The managers of the Oberoi group makes use of the trial balance to initiate the preparation of income statement as per the dates specified in the company. In the preparation of trial balance the accountant must ensure that credit balances and debit balances are matched in the accounts. Each transaction is posted firstly in trial balance and then it goes to financial statements which guides the accountants in rectifying the errors in financial statements that are daunting the activities of the company( Kapiki, 2011).

|

Particulars |

L/F |

Debit Amount |

Credit Amount |

|

|

Opening Stock Ramsay tools |

– |

86,000 |

268,000 200000 |

|

|

Total |

2,577,680 |

2,577,680 |

||

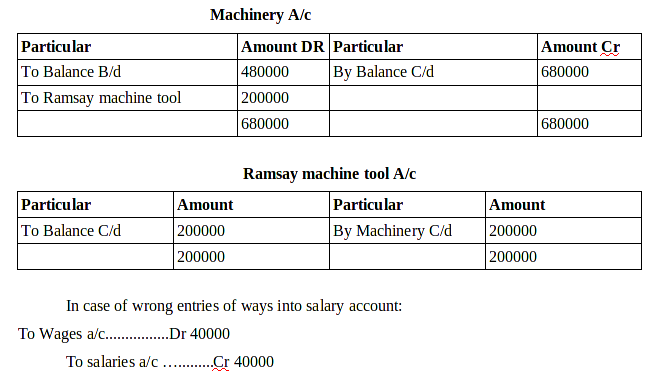

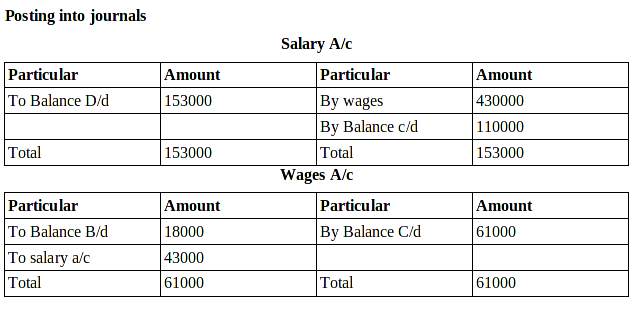

3.2: Evaluate the business accounts and adjustments

|

Trading and income statements of ABC Ltd |

|||

|

Particular |

Amount |

Particular |

Amount |

|

To opening stock |

86000 |

By sales |

1548700 |

|

To purchase |

1136000 |

||

|

To wages 18000 |

|||

|

Add: Transfer from salaries 43000 |

61000 |

||

|

To carriage inwards |

26900 |

||

|

To gross profit |

238800 |

||

|

Total |

1548700 |

1548700 |

|

|

By Gross profit |

238800 |

||

|

To salaries 153000 |

By rent received |

178300 |

|

|

Less: Transfer to wages 43000 |

110000 |

||

|

To trading charges |

64000 |

||

|

Carriage outwards |

52500 |

||

|

To commission |

42780 |

||

|

To Net profit |

147820 |

||

|

Total |

417100 |

Total |

417100 |

3.3: Process and purpose behind preparation of budgetary control

Purpose of Budgetary control:

- The budgetary control assists the managers in the comparing actual results with the budgeted ones so that company can ensure that resources and finance of business are utilised in an efficient manner.

- The main motive behind the preparation of budgets is to reduce and eliminate the amount of wastages by utilising resources as defined in budgets, which increases the profitability of company( Gursoy, Rahman, and Swanger, 2012).

Process:

- Gathering of information from relevant sources.

- Keeping in record all sources of income.

- Keep track record of monthly expense.

- Dividing expenses under various heads.

- Estimation of monthly income and expense.

- Making adjustments to reduce expense.

- Cutting expenditure.

- Review budget Monthly.

- Planning for infrequent expenses.

3.4: Analysing variances from budget and actual figures

(A): The material total variance

|

Material total variance |

||||

|

Particular |

Standard |

Actual |

Variance |

Results |

|

Total units sold |

1200 |

1000 |

200 |

|

|

Standard cost of a products |

60000 |

47500 |

12500 |

F |

(b): Total material price variance

|

Total direct material variance |

||||

|

Particular |

Standard |

Actual |

Variance |

Results |

|

Total units sold |

50000 |

47500 |

2500 |

F |

(c): Total material usage variance

MUV: Selling price ( Actual quantity * Standard quantity)

: 50(1000-1200)

: -10000 Adverse

TASK 4

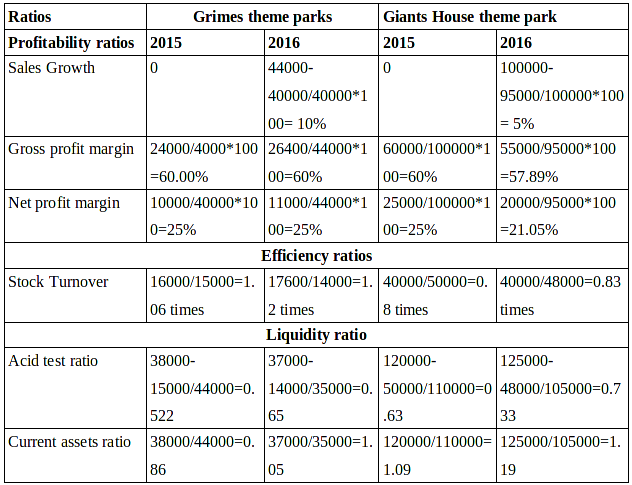

4.1: Calculating various ratios of the given companies

Profitability ratios: The profitability ratios are ascertained by the companies in order to know about the profit making ability of the company and how efficient and consistent company is generating profits. The profitability ratios are calculated in proportion to the total revenue of the company. The ratios which are calculated under this head include net profit margin, gross profit margin etc.

Liquidity ratios: These are the ratios which are estimated by the company for measuring the ability of the company to meet the short term obligations and the liquid assets of the company. The ratios which are calculated under this include current ratio, acid test ratio, defence interval ratio etc( Engel, Fischer, and Galetovic, 2013).

Efficiency ratio: This ratio is calculated to measure how efficient the business is in utilising the assets and other resources of the business. It is the duty of the managers to ensure that the assets of the company are optimum utilised for the better productivity. The turnover of the company is considered under its calculation:

4.2: Recommend future management strategies

The company needs to perform a proper analysis in order to initiate a new venture and for efficient business planning. Formulating Strategies will be very essential for the business to initiate better future activities that will impact the position of the business. According to the nature of the business shaping and forming valuable decisions for attaining maximum profitability in the business. The business can inculcate and incorporate lot of small missions and objectives that will prove to be crucial for the betterment of organisation.

TASK 5

5.1: Formulate categories as Fixed, variable and semi-variable

According to the mentioned scenario:

Fixed cost: These are those cost who are fix in nature and that are not changed by the company increases the production up to a certain level. Example- rent of building(Chen, 2012).

Variable cost: this is the cost which increases with the increase in the units of production produced by company. Example: Raw material

Semi-variable: This is the cost which is fixed to the some extent and after that it becomes variable. It is inclusive of both variable and fixed cost.

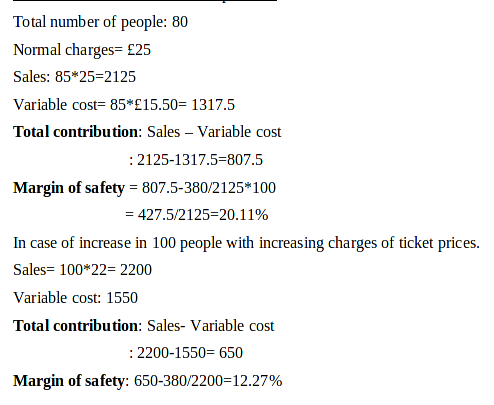

5.2: Calculation of contribution per unit

5.3: Justify Short-term management decision

The case study shows a typical case under which management accounting can assists the managers in finding valuable outcomes. This kind of information assists the managers in taking valuable decisions in short time period so the profitability can be enhanced.

CONCLUSION

As per the above project, it has been concluded that finance is the significant part in hospitality for the decision making as well as in efficient operations of business. The report will provide an understanding about the various sources and about ratios that are calculated. The analysis of financial statements using trial balance.

Visit the sample section of our website to enjoy more such informative write-ups and if you are looking for buying an assignment then visit our buy assignment section.

REFERENCES

Books and Journals:

- Chen, M. H. , 2012. State dependence in the influence of monetary policy regime shifts on hospitality index returns. International Journal of Hospitality Management. 31(4). pp.1203-1212.

- Engel, E., Fischer, R. and Galetovic, A. , 2013. The basic public finance of public–private partnerships. Journal of the European Economic Association. 11(1). pp.83-111.

- Gursoy, D., Rahman, I. and Swanger, N., 2012. Industry's expectations from hospitality schools: What has changed?. Journal of Hospitality & Tourism Education. 24(4). pp.32-42.

- Kapiki, S. T. , 2011. The impact of economic crisis on tourism and hospitality: results from a study in Greece. Browser Download This Paper.

- Liu, H., 2012. The hospitality business management problems and solutions analysis. ä¸å›½å¯¹å¤–贸易 (英文版). 2. p.275.

- Lupton, J.R., 2013. Hospitality. In Early Modern Theatricality.

- Paster, D. J. , 2013. Session 2-4-E: Financial Evaluation Commonalities and Distinctions Expressed by 10-Ks with Two Libertarian Hospitality Segments: Casino Gaming and Gentlemen’s Clubs.

- Sisson, L. G. and Adams, A. R. , 2012. Identifying Gaps in Curriculum with the Identified Knowledge, Skills and Abilities Important to Hospitality and Tourism Management Graduates.

- Tsai, H., Pan, S. and Lee, J. , 2011. Recent research in hospitality financial management. International Journal of Contemporary Hospitality Management. 23(7). pp.941-971.

- Yuan, B., Li, J. and Zeng, G. , 2018. Corporate liquidity management and technical efficiency: Evidence from global listed hospitality enterprises. International Journal of Hospitality Management. 74. pp.40-44.